SALES INFINITE DIGITAL INSURANCE

Modern Policy Administration System and Your complete solution for digital distribution

DIGITAL INSURANCE FOR THE SME SEGMENT

![]() Commercial risks can be offered

to small, medium and micro enterprises via digital channel, building up on existing supply chain while

further strengthening them, making them more efficient, scalable, profitable and resilient

Commercial risks can be offered

to small, medium and micro enterprises via digital channel, building up on existing supply chain while

further strengthening them, making them more efficient, scalable, profitable and resilient

![]() Our platform can reduce sales

effort and cost for commercial insurance by more than 90%, making insurance business for small, medium

and micro enterprises not just profitable but lucrative

Our platform can reduce sales

effort and cost for commercial insurance by more than 90%, making insurance business for small, medium

and micro enterprises not just profitable but lucrative

![]() Digital channel opens new high

margin, high growth and scalable revenue channels for your business

Digital channel opens new high

margin, high growth and scalable revenue channels for your business

DIGITAL INSURANCE FOR PERSONAL LINES

![]() Digital distribution for personal

lines has been around for some time. But we have simplified the entire solution significantly. Our

SaaS solution can be deployed very quickly in a matter of just a few weeks giving you one of the

fastest time to market for both traditional and innovative insurance products.

Digital distribution for personal

lines has been around for some time. But we have simplified the entire solution significantly. Our

SaaS solution can be deployed very quickly in a matter of just a few weeks giving you one of the

fastest time to market for both traditional and innovative insurance products.

![]() Whether you offer Auto Insurance,

Home Insurance, Travel Insurance, Health Insurance, Life Insurance or more, our solution helps you

reach your customers at scale while enhancing customer experience.

Whether you offer Auto Insurance,

Home Insurance, Travel Insurance, Health Insurance, Life Insurance or more, our solution helps you

reach your customers at scale while enhancing customer experience.

![]() With one of the most friendly

user interface that resembles the digital experience of premium retail brands, your customers can

avail insurance cover via laptop, desktop or mobile any time from anywhere at their convenience.

With one of the most friendly

user interface that resembles the digital experience of premium retail brands, your customers can

avail insurance cover via laptop, desktop or mobile any time from anywhere at their convenience.

![]() Sales Infinite is one of the most

advanced and user friendly platform that is technically very simple to implement and manage.

Sales Infinite is one of the most

advanced and user friendly platform that is technically very simple to implement and manage.

WHY CHOOSE SALES INFINITE ?

Traditionally it takes

2-3 weeks to provide a cover

Takes further 2 weeks to

provide policy document

Cost of business acquisition

can be as high as 40-60%

Takes 2-3 months for the

premium to reach the Insurer

Sales Infinite

can provide

cover in just 5-10 minutes

Sales Infinite

provides

policy documents instantly

Sales Infinite

reduces

acquisition cost by 90%

Insurers can receive

premium instantly

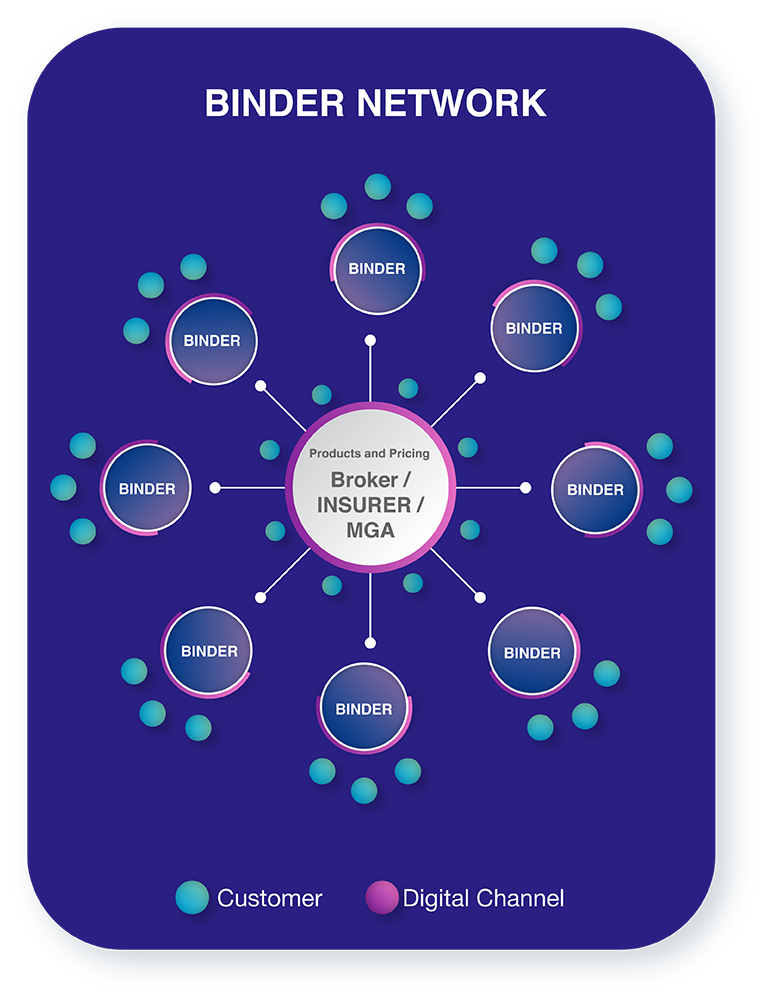

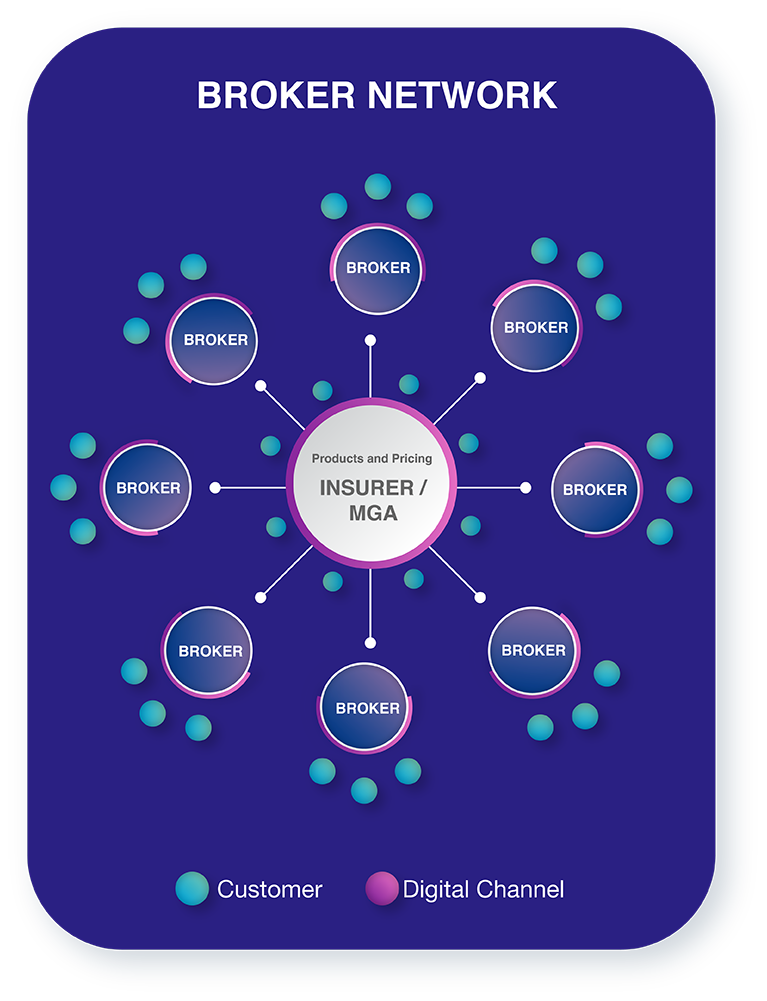

DISTRIBUTION SCHEMES

Whether you are a Broker / Insurer / MGA looking for efficient distribution channel

with your Binders / Placing Brokers or an Insurer / MGA looking for scalable distribution channel with

your Brokers, our platform can be configured to suit your distribution scheme. We can enable digital

channel at every or selective distribution nodes with custom branding.

INSURANCE PRODUCTS YOU CAN LAUNCH

COMMERCIAL LINES

Cyber

Landlord’s

Motor / Fleet

Marine Cargo

Construction

Public Liability

Product Liability

Employer’s Liability

Commercial Property

Professional Indemnity

And more …

PERSONAL LINES

Pet

Auto

Life

Home

Yacht

Travel

Travel

Health

Critical Illness

Accident & Illness

And more …

SIMPLE EQUATIONS WITH GREAT RESULTS

BENEFITS / VALUE SUMMARY

Increase Revenue

A platform for scalable growth

Better customer satisfaction

Streamlined user friendly customer journey

Higher profit margin

Improve cashflow

Serve customers on demand

Accurate data collection